Estate Planning

|

|

|

By David T. Phillips, CEO, 9/17/19

Estate Planning Specialists

The other day I met new clients for the first time, Jim and Debbie. I asked them to bring, among other documents, their current insurance policies and their Wills to the meeting. Jim and Debbie are in their early 40s and have twin daughters, Dana and Donna, age 10. While reviewing their current life insurance policies, I noticed a huge hole in their estate plan: the beneficiary designations of their policies were a mess. A mistake that we immediately corrected.

Here is what I read:

Jim’s Policy Primary Beneficiary: Deb, spouse of the insured. Contingent Beneficiaries: Dana and Donna, children of the insured.

You should never name minor children as direct or contingent beneficiaries of your policies, since a life insurance company can’t pay out proceeds directly to children until the children reach the age of majority, typically 18 or 21 depending on your state law.

In most jurisdictions, to protect the interests of a minor, state law requires appointment of a guardian or trustee to administer proceeds payable to the child. Appointment proceedings will delay access to the death proceeds and generate unnecessary legal and administrative expenses. Furthermore, the fiduciary named by the court may not be the one the insured would have chosen if they had made this decision during their lifetime.

This is what Debbi’s policy read:

Deb’s Policy Primary Beneficiary: Jim, spouse of the insured. Contingent Beneficiaries: (none indicated).

You should always designate a contingent beneficiary in all of your life insurance policies, and in most cases, the beneficiary designation should be worded in a way that will best benefit your children.

Having no named contingent beneficiary is the same as naming your estate as the beneficiary. Is this a bad thing? It can be; in the absence of a Will designating a guardian or trustee, the courts will intervene, which may cause long, frustrating delays. The courts could also impose restrictions on how the proceeds will be spent or distributed, which may be contrary to what you would have wanted for your children.

While Jim and Deb have gone to great lengths to protect their children (that’s a major reason they purchased the life insurance), they needed proper advice when establishing their policy in the beginning. It is also important that the beneficiary designations allow for the distribution of the life insurance proceeds in the most disciplined manner possible to provide maximum benefit to the children when you are gone.

Okay—here are some practical ways to ensure that minors, through the people entrusted with their care, have access to the life insurance proceeds intended for them:

Option 1:

Make the contingent beneficiary of the insured’s life insurance policy a Testamentary Trust in your Will.

The terms of your Will can contain this trust, which does not spring to life until your passing. Referencing the trust in the Will is a precise way to ensure that your exact wishes for your children are followed. The trust, which is a legal document, names the person you choose as the Trustee, and describes how you would like to have the money managed and spent and for how long. An 18-year-old may be an adult under the laws of many states, but the client’s testamentary trust could be written to keep the newly-minted adult from blowing the money.

- In this case, the contingent beneficiary section of the life insurance application should state: (Trustee’s Name) as Trustee under (Article X) of (Jim or Deb’s) Last Will and Testament dated (January 1, 20XX).

Option 2:

Taking advantage of the Uniform Transfers to Minors Act (UTMA)

is an excellent way to ensure that children receive proceeds from a life insurance policy, especially if you have not yet executed your Wills. Under the UTMA, you would name an adult custodian who is given the discretion to make distributions for the minor’s welfare. The UTMA account (which is essentially a statutory trust) allows parents to choose a custodian—a person they trust—who would manage the life insurance death proceeds, and other assets they might have in the account, as they see fit prior to the children reaching majority.

- Some insurers have a specific form to assist in making a beneficiary designation with UTMA custodian the beneficiary or contingent beneficiary of a life insurance policy.

- If no special form is available, the following wording would generally be accepted: (Custodian’s Name) as custodian for (child’s name) under the (State) Uniform Transfers to Minors Act. Note: you should confirm with the insurance company for the specific wording they would accept.

Option 3:

Designate a Revocable Living Trust (Family Dynasty Trust) as beneficiary or contingent beneficiary in place of the child directly.

This is similar to the testamentary trust referenced above, except that a Living Trust exists at the moment it is executed, whereas the trust in a Will (testamentary trust) begins its life only at the insured’s death. Like the trust in a Will, a Living Trust allows the insured to detail the terms and conditions of gifts and plan for every contingency. The only downside of this type of trust is that it will require some level of administration from the outset. If you have a child with special needs, you absolutely should have a living trust. If your net worth is in the tens of millions, it’s a no-brainer, and in that case, you might want to establish an Irrevocable Dynasty Trust as well.

Should you have any questions regarding your beneficiary designations, give us a call, 1-888-892-1102.

- - - - - - - -

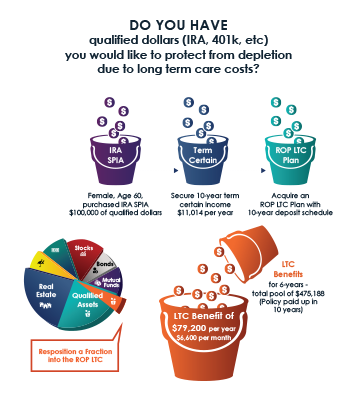

Many of our clients have qualified assets (IRA/401k, etc) they intend to use for retirement income. However there is one unknown factor that could unwind the best laid plans – Long Term Care (LTC) expenses.

The most prudent way to insulate these precious funds is to implement what we call The IRA Leveraged LTC Strategy (IRA LLTC Strategy). Simply stated, with the IRA LLTC Strategy you transfer a portion of your “Qualified” funds, like your IRA into a special income annuity known as a 10-year Certain Immediate Annuity. Then annually for 10 years, you transfer the Annuity income into the Return of Premium LTC plan. Fully funding guaranteed Long Term Care protection that will leverage your transferred IRA up to 10 times!

Because the income generated from the Immediate Annuity will be taxed annually as a “Qualified” distribution, income taxes will be due April 15th of the year following the distribution. However, considering that you would have had to pay taxes on the IRA distribution down the road at potentially higher tax rates, and the immense leverage you generate, the small conversion tax you pay to obtain the IRA LLTC Strategy today is well worth it.

Because the income generated from the Immediate Annuity will be taxed annually as a “Qualified” distribution, income taxes will be due April 15th of the year following the distribution. However, considering that you would have had to pay taxes on the IRA distribution down the road at potentially higher tax rates, and the immense leverage you generate, the small conversion tax you pay to obtain the IRA LLTC Strategy today is well worth it.

LET’S LOOK AT AN EXAMPLE

Allison, 60, is in good health and married. She is concerned about Long Term Care after seeing how those expenses impacted her parents’ retirement plans. Allison’s parents thought they were all set, (and they were), until extended care expenses depleted their savings.

Allison’s father passed away first after a long illness. His extended LTC expenses significantly impacted her mother’s plans. You see she had hoped to travel with her friends after her husband’s passing, but because most of their retirement money was spent on his care, her plans took a back seat. Then to make matters worse, her mother had three years of LTC expenses of her own. The money she was hoping to leave her family evaporated. It was gone.

THE STRATEGY

This was a wake-up call for Allison. After discussing her situation with us, she decided an ROP LTC Plan would best fit her needs. She really liked the flexibility and simplicity of the Tax-Free Cash Indemnity monthly payout. With no restrictions on how LTC benefits can be used, Allison will be able to use her tax free cash to pay for a variety of needs that may not be covered by the typical reimbursement LTC policy. Benefits such as using her monthly payout to cover the costs of informal care from an immediate family member, or hiring less expensive and potentially more accessible unlicensed caregivers.

After getting approval for her Return of Premium LTC plan, she transferred $100,000 from her IRA into a 10-year Certain Income Annuity that produced a taxable annual income of $11,014 of which she is now using to fully pay up her ROP LTC Plan without an inflation rider.

Allison decided to pay taxes due on the annuity distribution out of pocket to preserve more funds for her ROP LTC plan. Her premium is guaranteed to remain the same and the policy will be fully paid up in 10 years. Her 10 year IRA conversion will generate an immediate and perpetual leveraged LTC benefit totaling $475,188 ($4.75 to $1) – $6,600 per month, for 72 months. In addition, should Allison pass away without needing her LTC benefits, there is a life insurance benefit of $158,396 that will be paid tax-free to her beneficiaries ($1.58 to $1).

Had Allison decided to choose the 5% Simple Inflation Rider her immediate LTC pool would have been $293,666. In 20 years, at age 80 it would have increase to $541,650 or $7,070 a month for 72 months. Fully guaranteed!

Now that’s what I call leverage!

To receive your own personalized example of how the IRA Leveraged LTC Strategy could work for you call 1-888-892-1102 or complete the ROP LTC Request Form by clicking the button below.

|

|

|

Read more: Rich Americans switch up money plans to soften Biden’s proposed tax hikes