Americans can now exclaim “EUREKA!”

Americans can now exclaim “Eureka” when it comes to finding the cash to fund today’s top Long-Term Care solution, The ROP LTC Plan.

By David T. Phillips, CEO

Estate Planning Specialists

“Eureka” was a word of excitement that the California 49ers would shout out when finding a rare gold nugget. Americans can now exclaim “Eureka” when it comes to finding the cash to fund today’s top Long-Term Care solution: The Return of Premium Long-Term Care Plan.

Universally, everyone that honestly examines the new ROP LTC Plan concludes that it makes fiscal and logical sense. The one obstacle that seems to interfere in the acquisition process is one’s inability to find the cash resources to fund it.

Well now thanks to Uncle Sam and The ROP LTC Plan’s unique design, you can use “pre-tax dollars to fund it.” That’s right, tax deductible dollars can be transferred from a tax deferred account to fund a plan that generates a “Tax-Free” monthly long-term care benefit. It doesn’t get any sweeter than that.

Let me explain.

In 2003 Congress created The Health Savings Account (HSA). Recent favorable HSA amendments now allow for HSA funds to be used to pay for long term care insurance as a qualified medical expense. Since the ROP LTC plan is comprised of two parts: the life insurance and the tax qualified LTC portion, the LTC portion can be funded with non-taxed HSA dollars.

And that’s a “Eureka” moment for those that can qualify for the ROP LTC Plan but have been wondering where they can find the money to fund it. Let me give you an example: Howard is age 62, he currently has $35,000 in his HSA account. He qualifies for The ROP LTC Plan and decides he wants to deposit $15k annually for 7 years to fund his plan. He immediately creates a Long-Term Care pool of $284,717, 19 times the initial transfer. Because he includes the 5% compound inflation option, by age 80 his pool will increase to $685,205, payable TAX FREE over 72 months. He will also have a life insurance benefit of $105,000.

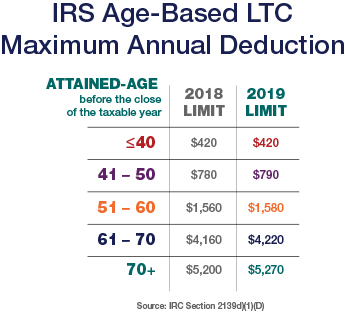

A closer look at Howard’s 7 year deposit of $15k finds that $7,364 is used to fund the paid up life insurance policy and $7,636 to fund the LTC portion which can come from his HSA account up to the age based maximum deduction of $4,220 set by the IRS, (see table). Howard will fund the $15k annual premium each year by writing two checks: one from his tax-deductible HSA for $4,220 for the 7 years, and the other for $10,780.

A closer look at Howard’s 7 year deposit of $15k finds that $7,364 is used to fund the paid up life insurance policy and $7,636 to fund the LTC portion which can come from his HSA account up to the age based maximum deduction of $4,220 set by the IRS, (see table). Howard will fund the $15k annual premium each year by writing two checks: one from his tax-deductible HSA for $4,220 for the 7 years, and the other for $10,780.

Over the 7 years Howard will fund his ROP LTC plan with 28% pre-tax dollars. Should he ever trigger the LTC benefit, it will be paid out with 100% TAX FREE dollars making it all the more reason for him to yell out…….Eureka!

To receive your own personal example of how the ROP LTC would work for you, and how much can be funded from your HSA account, call our offices today at 1-888-892-1102 and schedule a time to talk to Todd or myself.