Estate Planning

Long Term Care Insurance — Act Now!

By Terry Savage

June 16, 2020

One of the most tragic aspects of the coronavirus pandemic is that as of June 3, 42% of all COVID-19 deaths in the U.S. have come from nursing homes or assisted-living facilities. The statistics reinforce every senior’s desire to remain at home in his or her final years, which is only possible if you have the resources to afford this very expensive home health care — or if you have long-term care (LTC) insurance. Otherwise, state Medicaid programs provide care for the impoverished, though mostly in institutions.

Perhaps because of this growing awareness (or ongoing low interest rates earned by insurers), prices of the newest hybrid/combo LTC policies are starting to rise. David Phillips, an estate planning specialist and consumer resource for LTC insurance at ROP LTC (www.ropltc.com), has issued a warning of a 10% to 15% price increase on July 15 for new applicants for one of the best hybrid LTC policies for people under age 71. Other insurers are likely to follow.

Long-term care insurance: The basics

Traditional, annual-premium LTC insurance policies got a bum rap in recent years, as insurers unexpectedly raised the annual premiums. Then along came a new era in long term care policies — the “combo” or “hybrid” policies, most of which are based on a life insurance policy and offer a fixed one-time premium, or a series of fixed payments.

Combo policies offer both an expanded pool of benefits to be used for long-term care costs and a death benefit for the heirs if the care isn’t used (or a guaranteed return of premiums paid). Premiums can’t rise along the way because you either make one single deposit or, depending on your age, have the choice to spread out your deposits from five to 15 years. Either way, your premium will buy you an expanded guaranteed benefit pool of tax-free cash and/or a death benefit.

For example, Brian Gordon of Murray A.Gordon Associates Long Term Care experts (800-533-6242) offers this example of a combo policy for a single 60-year-old single woman using the Securian (Minnesota Life) SecureCare product.

The quotations assume good health at time of purchase, and a 90-day elimination or “waiting” period before benefits begin after a physician certifies her inability to do two basic activities of daily living or she becomes cognitively impaired. SecureCare pays out a cash indemnity monthly benefit, which means you could use the money to pay anyone, even a relative, to care for you, or to pay for a home health care aide or a care facility.

A single deposit of $100,000 into SecureCare would generate an initial monthly LTC benefit of roughly $4,000 per month, for six years — a total initial pool of benefits just over $318,000. But because a 3% compounding inflation rider was added, at age 85 the monthly benefit will increase to over $8,500 per month, for a total available LTC pool of $666,291 — more than 6.5 times her initial premium. Should she die without using the care, her heirs would receive a death benefit of nearly $110,000.

If instead of a single deposit she chose to deposit her $100,000 over 10 years — $10,000 per year, the overall benefits would be reduced by about 10%.

Act Now — Prices rise soon

David Phillips notes that a 60-year old married man could today make a $100,000 deposit into a policy with a 5% inflation rider that would increase his LTC benefits to over $1 million by age 85. But after prices rise on July 15, it will take an initial deposit of roughly $113,000 to get the same benefit.

It’s important to be guided in your purchase of LTC insurance by an independent and knowledgeable agent. I can highly recommend these three independent agents. (Note: I receive absolutely no benefit from these recommendations.)

—David Phillips at Estate Planning Specialists, 888-892-1102 or www.ropltc.com

Sadly, it has taken a pandemic to demonstrate the need for long term care insurance. But now you know. And if this purchase makes sense in your total finances, now is the time to act. That’s The Savage Truth.

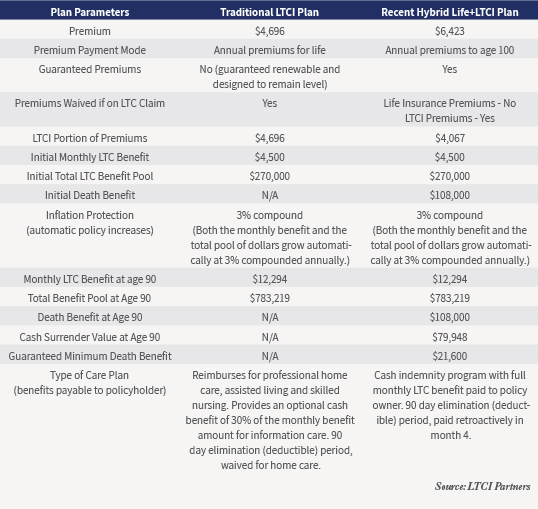

A PICTURE IS WORTH A THOUSAND WORDS! Thanks to Tom Riekse, Jr of www.LTCIPartners.com for this chart below:

By David T. Phillips, CEO

Estate Planning Specialists Because you recently asked me to send you our Special Report on the new Return of Premium Long Term Care Plan I wanted to share with you a conversation I had the other day with a client when telling her the good news that she was approved for coverage.

Bonnie (not her real name) is a single, 58 year old nurse from Michigan. She called us a few weeks ago, after reading about my firm and The ROP LTC Plan in Bob Carlson’s Retirement Watch newsletter. After a series of discussions and illustrations, she completed an application and the interview with the underwriter. She was now approved and it was time for her to transfer the funds to bind her coverage.

While these are not her exact words, this was the gist of our conversation:

“Thank you David for making this happen. With my ROP LTC Plan, I now have options. Before today, I really only had one option, and that was to hope my savings and retirement plans lasted through any long term medical situation I might experience. I mean, as I nurse I have seen it all. I know firsthand that anything can happen.Now with my ROP LTC Plan in force, I have options.

Let’s say, 10 years from now, I slip and fall on the ice and find myself disabled. Since my ROP LTC has an Indemnity pay out after 90 days, I will have plenty of tax-free cash to do as I please.If I want to have my friend Charlotte move in and take care of me, I can.

If I want to relocate to Florida so my daughter can watch over me, I can. And in both cases I can pay them a tax-free salary, from the cash I will receive from my ROP LTC Plan.

If I want to stay here in my home in Michigan and have a professional care giver take care of me, I can. In that case I will be able to use the tax-free cash from my ROP LTC Plan to pay for my care and will not be forced to deplete any of my other assets.

If I want to move to “Friendship Village” and have them take care of me, I can use the cash from my ROP LTC Plan to pay for it.Point is David, I have options, plenty of them. Before I talked to you, I really only had one option and that was to spend down all of my cash first, then sell off everything else.

Now I have endless options. And what’s more,

it really isn’t costing me anything.

I just transferred $100k from a silly CD that was set aside to pay for a potential LTC event. Now I am initially leveraging that $100k by a factor of 3, and because I have included an inflation rider that factor will increase as high as 6 times.

Furthermore, if I get lucky and am one of the 20% that miss the LTC train, all of my deposit is returned to my ultimate beneficiaries at my passing. It is just like you said when I first called you. I transferred my CD funds from my left pocket to my right pocket and the money is still on my balance sheet, but now I have options.

All it is costing me is the use of that CD money through the years and SO WHAT. I was hardly earning any net after-taxed interest anyway. And had I invested it in the market when it came due, chances are I probably would have lost it anyway.

Now I have options – so many options.

David, I can’t imagine why everyone else doesn’t jump on this opportunity while they can.”

Bonnie absolutely gets it and she is right! Everyone should know about the leverage and benefits of the ROP LTC Plan and the peace of mind it creates.

With the ROP LTC Plan, Bonnie is confident in her future and doesn’t worry about tomorrow. Best of all, since every aspect of her ROP LTC Plan is completely guaranteed, she will NEVER have to worry where the cash is coming from to take care of her, should her LTC train arrive at the station.

Your first step is for you to find out for yourself what your ROP LTC Plan would look like should you reposition some of your assets. For your convenience, simply complete the ROP LTC Analysis Request Form CLICK HERE to submit your Request online and we will send to you at no cost your personalized ROP LTC Summary.

Feel free to call our office if you have any questions – 1 888-892-1102

Estate planning is the act of preparing how your assets will be distributed at death. It is often touted as money planning. Who gets what and when do they get it? But the real issue is people and the problems they face at your death. Spouses, children, grandchildren, dependents, business partners, and others will suffer not only emotionally but also economically if you fail to plan. Taking care of people problems is the main objective in estate planning. Estate planning is people planning.

In our business we meet wealthy people daily. We’ve always had a difficult time understanding why a large number of affluent American’s with huge estate tax liabilities refuse to address planning their estates. But even if your estate isn’t as large as Michael Jackson’s, the last thing you want is to leave behind a frenzy of loved ones fighting over your estate. When done correctly, you can leave a clear, concise and well managed plan to distribute your assets so your family and loved ones can focus on bonding and start the healing process.

We spend a lifetime raising families, creating income, taking care of people, and planning for the future, and in an instant it can end. We lose our opportunity for a plan of continuation if we fail to plan before death. Estate Planning is really living planning. Generally, the planning takes time, thought, and guidance and can appear complicated and confusing. But take heart, it can be simplified.

We’ve spent years trying to make estate planning easy. Here’s how to get started:

- Order your comprehensive Estate Analysis and complete our Personal Estate Profile form.

Americans can now exclaim “Eureka” when it comes to finding the cash to fund today’s top Long-Term Care solution, The ROP LTC Plan.

By David T. Phillips, CEO

Estate Planning Specialists

“Eureka” was a word of excitement that the California 49ers would shout out when finding a rare gold nugget. Americans can now exclaim “Eureka” when it comes to finding the cash to fund today’s top Long-Term Care solution: The Return of Premium Long-Term Care Plan.

Universally, everyone that honestly examines the new ROP LTC Plan concludes that it makes fiscal and logical sense. The one obstacle that seems to interfere in the acquisition process is one’s inability to find the cash resources to fund it.

Well now thanks to Uncle Sam and The ROP LTC Plan’s unique design, you can use “pre-tax dollars to fund it.” That’s right, tax deductible dollars can be transferred from a tax deferred account to fund a plan that generates a “Tax-Free” monthly long-term care benefit. It doesn’t get any sweeter than that.

Let me explain.

In 2003 Congress created The Health Savings Account (HSA). Recent favorable HSA amendments now allow for HSA funds to be used to pay for long term care insurance as a qualified medical expense. Since the ROP LTC plan is comprised of two parts: the life insurance and the tax qualified LTC portion, the LTC portion can be funded with non-taxed HSA dollars.

And that’s a “Eureka” moment for those that can qualify for the ROP LTC Plan but have been wondering where they can find the money to fund it. Let me give you an example: Howard is age 62, he currently has $35,000 in his HSA account. He qualifies for The ROP LTC Plan and decides he wants to deposit $15k annually for 7 years to fund his plan. He immediately creates a Long-Term Care pool of $284,717, 19 times the initial transfer. Because he includes the 5% compound inflation option, by age 80 his pool will increase to $685,205, payable TAX FREE over 72 months. He will also have a life insurance benefit of $105,000.

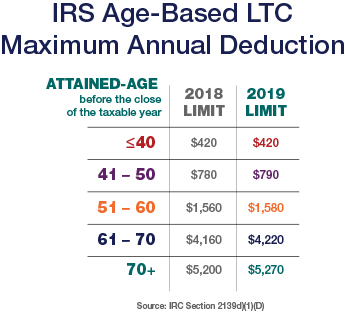

A closer look at Howard’s 7 year deposit of $15k finds that $7,364 is used to fund the paid up life insurance policy and $7,636 to fund the LTC portion which can come from his HSA account up to the age based maximum deduction of $4,220 set by the IRS, (see table). Howard will fund the $15k annual premium each year by writing two checks: one from his tax-deductible HSA for $4,220 for the 7 years, and the other for $10,780.

A closer look at Howard’s 7 year deposit of $15k finds that $7,364 is used to fund the paid up life insurance policy and $7,636 to fund the LTC portion which can come from his HSA account up to the age based maximum deduction of $4,220 set by the IRS, (see table). Howard will fund the $15k annual premium each year by writing two checks: one from his tax-deductible HSA for $4,220 for the 7 years, and the other for $10,780.

Over the 7 years Howard will fund his ROP LTC plan with 28% pre-tax dollars. Should he ever trigger the LTC benefit, it will be paid out with 100% TAX FREE dollars making it all the more reason for him to yell out…….Eureka!

To receive your own personal example of how the ROP LTC would work for you, and how much can be funded from your HSA account, call our offices today at 1-888-892-1102 and schedule a time to talk to Todd or myself.