Weiss Education October 2017

Not properly preparing for the exorbitant cost of long-term medical care

October 18, 2017

Life never goes according to plan. If we had a magic wand, we'd all peacefully die in our sleep on our 93rd birthday after living an invigorating life. That way we'd never have to be a burden on our children or spend a fortune during the last few years of our lives in an assisted living facility or a nursing home.

According to poll after poll, the biggest fear most Americans have is that our health will fail, we'll get stuck in a costly Long-Term Care facility, run out of money, and die destitute and alone. In fact, today more than ever, as baby boomers deal with their own probable longevity and the care of their parents and loved ones, the topic of providing for their own care has catapulted to the top of the list of concerns.

You don't need to panic, but you do need to know the hard truths about the Long-Term Care crisis.

According to the Health Insurance Association of America, roughly 72% of Americans over age 65 will require some form of long-term care and 30% will require nursing home care.

At a national average annual cost of $90,000 for a nursing home, $70,000 for home care and $43,000 for an assisted living facility, a lengthy illness could financially wipe you out.

Are you prepared to take the chance that your assets will endure the potential costs of a long term illness or an accident? Have you taken any steps to shield your investments from the ruthless tentacles of a long term medical event?

Another fact to consider is that with the lack of adequate funds we limit our options. The main reason why 80% of those who receive Long-Term Care services do so at the hands of unpaid family members is because there isn't another option.

Caregiving involves lifting, bathing and toileting which can take an emotional and physical toll. It's no wonder that a spouse caring for their disabled spouse is 6 times more likely to suffer from anxiety or depression. Not to mention the time it takes away from one's normal daily activities, such as work, being with other family members, vacations and basic alone time.

So what is the answer, the federal and state governments elder care fund? Not hardly.

|

To qualify for even the lowest form of care from Medicare we have to entirely spend down all of our assets to the point we become totally flat broke. Worse still, our surviving spouse gets a double whammy. If your life savings are spent caring for one spouse, the surviving spouse will need to depend on family, Medicaid and welfare for their care and basic living expenses. As harsh as it may sound, that option gets old fast.

Most of us are living this reality in some fashion or another as our spouse, parents, siblings and friends experience a long term care event. They deserve our loving care, but in most cases we are their only option. Do we want to paint ourselves and our children into the same corner?

So what are our options?

Solution:

In reality, other than doing absolutely nothing and pray that the LTC bomb misses you, there are three options:

Option 1: Purchase traditional Long-Term Care Insurance.

Option 2: Be rich enough to pay for everything or self fund.

Option 3: Reposition some of your assets into a Leveraged Care Solution.

The premise behind stand alone traditional Long-Term Care Insurance is like any other insurance. In exchange for annual premium payment, an insurance company promises to pay a pre-specified amount in Long-Term Care benefits.

However, stand alone LTC insurance is losing market share in a big way. In fact, in 2000, 700,000 policies were sold, in 2015 only 100,000.

However, stand alone LTC insurance is losing market share in a big way. In fact, in 2000, 700,000 policies were sold, in 2015 only 100,000.

Why the decline? The reasons are simple: Long-Term Care insurance premiums have skyrocketed, qualifying isn't easy, 90% of Long-Term Care insurers have abandoned the business and it is a “use it or lose it” contract.

Just like fire insurance; if your house doesn't burn down…you don't get paid. Likewise, if you're lucky enough to make it through life without needing Long-Term Care, all those thousands of dollars in premium you paid, will be for nothing.

If you have sufficient assets, you can always self-fund your Long-Term Care costs. In short, pay for everything out of your own pocket. The appeal of self-funding is that you don't have to pay premiums to any insurance company and you only pay for services that you need.

As we all know, however, Long-Term Care expenses can add up fast and can easily gobble up over $100,000 a year, based on today's dollar. Tomorrow, we know for certain that care cost will escalate to unprecedented numbers in the future.

That is why most people who choose to self-fund their Long-Term Care needs either mentally or physically set up a separate Long-Term Care fund. This money should be invested in safe money vehicles, be totally liquid, and not be subject to stock market risk. The money needs to be readily available.

The problem with readily available, it also means low yielding. And in today's extremely low interest rate environment, that means you'll be lucky to make 1%.

Of course, self-funding requires that you set aside a sufficient amount of money — generally several hundred thousands of dollars — to cover expenses, if everything goes according to Plan A.

Remember, however, should you self fund, the money you set aside will ONLY be worth what it is worth when being used for long-term medical care. In other words, $100,000 is $100,000.

For the last three decades — other than self funding, as pointed out earlier, the only way to finance potential Long-Term Care expenses was to purchase a standalone Long-Term Care Insurance policy. THAT IS UNTIL NOW!

Thanks to the Pension Protection Act of 2006, there is now a better option; an option we call The Leveraged Care Solution (LCS). Others refer to it as The Asset Based Care Strategy.

Section 844 of the Pension Protection Act of 2006 permits you to reposition your self-funded dollars that you intend to use for Long-Term Care into a new type of account via an insurance company that magnifies those dollars, depending on your age, up to 10 times, should you trigger a Long-Term Care event.

That's right; $100,000 of cash can increase up to $1 million that can be used to pay for your Long-Term Care expenses!

Because the funds you reposition into the Leveraged Care Solution are still an asset on your balance sheet, it is as if you transferred those dollars from your left pocket to your right pocket. The funds are still in your pocket if you need to access them, but if you leave them in your pocket and experience a Long-Term Care event, they are guaranteed to multiply many times their value.

That is leverage. Using pennies today to create dollars tomorrow.

Moreover, should you have the good fortune of dodging the Long-Term Care bullet, either your account balance or an expanded tax-free life insurance benefit will be transferred to your beneficiaries at your passing.

To trigger the care benefit payout, a professional care giver simply verifies that you are either cognitively impaired or you cannot perform 2 of the 6 Activities of Daily Living (ADLs) without assistance. The 6 Activities of Daily Living include: eating, bathing, dressing, toileting, transferring, maintaining continence.

Cognitive impairment essentially means you have medical documentation of dementia or Alzheimer's.

When the care benefit is triggered, the insurance company you have chosen will begin paying out an income tax free monthly benefit from your Long-Term Care benefit pool of multiplied funds.

When the care benefit is triggered, the insurance company you have chosen will begin paying out an income tax free monthly benefit from your Long-Term Care benefit pool of multiplied funds.

The monthly check is distributed from the pool based on the number of months you selected up front, 50 months to 90 months. Depending on the plan you choose, the care benefit payout is either a reimbursement of expenses or a cash indemnity (where no receipts are required).

Since Medicare will cover the first 90 days of a care event, most LCS monthly benefit payouts begin after a 90 day waiting period.

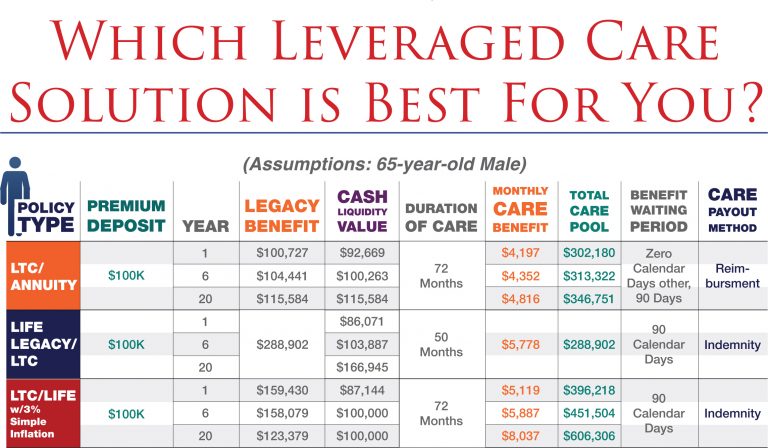

Within the Leveraged Care Solutions world there are three different options to choose from. The correct option for you is determined by your personal circumstances.

On the onset it is important to remember that with Leveraged Care Solutions you are simply repositioning an asset, usually a low yielding, unproductive asset. Furthermore, LCS weren't created to make you rich, they exist to prevent you from becoming poor!

From a wealth management perspective, because of the significant leverage created, even the wealthy should include a Leveraged Care Solution in their portfolio. Why pay for care out of your pocket and the pocket of your heirs, when an insurance company will pay for it with leveraged dollars?

So what are the three options when considering Leveraged Care Solutions?

The LTC/Annuity Combo

The LTC/Annuity combines two financial products rolled into one. First, it is a fixed annuity that pays current fixed interest rates. Second, it is a Long-Term Care policy with a monthly Tax-Free care benefit that is determined by the value of your annuity.

Should you trigger the LTC provision of the annuity by not being able to perform 2 of the 6 ADLs or by becoming cognitively impaired, your annuity increases up to three times its value, distributed over 6 years (72 months) for individuals and 7.5 years (90 months) for couples, by reimbursing long term medical expenses.

$100,000 increases to a minimum of $300,000. Repositioning $200,000 you create a LTC pool of $600,000, etc.

With all top LTC Annuities the monthly reimbursed care benefit increases through the years as your annuity increases in value. If you never activate the Long-Term Care provision of your annuity, your account balance will pass to your beneficiaries. In other words, if you never use it, you don't lose it. Either you or your heirs — not the insurance company — will keep your money.

To qualify for the LTC Annuity eligible applicants pass a simple 30 minute phone interview with no exam or lab tests required.

An example might help: Two 65 year old brothers, James and Larry, each have $100,000 to invest.

James puts his money into a CD paying an average 2% annually (wishful dreaming) while Larry invests his $100,000 in our recommended LTC/Annuity Combo plan.

Ten years later while on a fishing trip, their boat is struck by lightning and the brothers sustain injuries that prevent them from performing 2 of the 6 Activities of Daily Living. Both go into an assisted living facility at a cost of $4,750 per month, or $57,000 per year.

The CD that James invested in grew to $115,370, after taxes, and would pay for roughly 24 months of care in the facility. After 24 months, James would have exhausted all of his CD.

Larry also needs Long-Term Care, but his $100,000 LTC/Annuity cash value would have grown to $110,167.

Larry also needs Long-Term Care, but his $100,000 LTC/Annuity cash value would have grown to $110,167.

Because of the guaranteed 3 times LTC multiplier factor his total care pool would increase to $330,502 and since his monthly benefit is paid out over 72 months a check for $4,590 would be sent to the assisted living facility each month for 6 years. All tax free by the way!

After exhausting all his money, James was forced to go on Medicaid, while Larry on the other hand, received $4,590 tax-free per month for 6 years of Long-Term Care coverage compared to James' 2 years.

Turning Tax-Deferred into Tax-Free

If you have an old annuity with accumulated taxable gain, because of IRC Section 1035, you can exercise your right to exchange your annuity into a new LTC/Annuity Combo without any tax consequences.

Furthermore, because Section 844 of the 2006 Pension Protection Act, should you trigger the LTC benefits in your LTC/Annuity, not only will your transferred annuity increase up to three times, all of the gain you transferred from your old annuity will be paid out totally 100% income tax free. Now that's what I call SUPER-LEVERAGE!

In summary, the first Leveraged Care Solution referred to as a Long-Term Care Annuity is usually acquired by those that want to provide a guaranteed monthly care benefit that is worth up to three times the annuity value. It is also the LCS plan of choice those that want a Joint LTC benefit and those that currently have an annuity with substantial gain.

Life Legacy/LTC Combo

Built into a select few competitive life insurance policies is a monthly Long-Term Care benefit that is derived by extracting 2% to 4% of the life insurance face amount per month (50 months for the 2% option and 25 months for the 4%).

Again, because of Section 844 of the 2006 Pension Protection Act, the insured becomes the beneficiary of their own life insurance policy by claiming a Tax-Free monthly care benefit after triggering the LTC provision by not being able to perform 2 of the 6 ADLs, or by becoming cognitively impaired.

The Life Legacy/LTC plans are considered a life insurance policy first and a LTC benefit second. They are ideal for those that want to leave a leveraged magnified Tax-Free lump sum cash benefit for their beneficiaries, while providing a significant LTC benefit for themselves.

Generally with the Life Legacy/LTC Combo approach the insured transfers a low interest paying stagnant asset like a CD, Money Market or another source of lump sum cash into the selected plan. This creates an instant and perpetual multiple of the deposit into a guaranteed lifetime Tax-Free paid up life insurance policy with a tag-along Tax-Free LTC benefit.

Another Life Legacy/LTC option is to transfer funds over a number of years, instead of a single deposit. This method creates even more leverage by spreading out the deposits over time.

Today's top Legacy/LTC Combo policies pay out a monthly Cash Indemnity benefit and don't require the submission of receipts in order to receive the monthly maximum payout benefit. Once the LTC benefit is triggered, a Tax-Free check is sent to the insured or care provider that is determined by the upfront selected payout percentage based on the face amount of the policy.

Should any life insurance benefit remain undistributed for Long-Term Care benefits, the remainder is distributed, Tax-Free to your beneficiaries.

Should any life insurance benefit remain undistributed for Long-Term Care benefits, the remainder is distributed, Tax-Free to your beneficiaries.

Because the Legacy/LTC policies provide a substantial immediate and perpetual life insurance benefit, normal life insurance underwriting procedures are followed, requiring a paramedical exam, and lab work that usually takes four to six weeks for approval.

For Example: Rachel, age 65, is in average health. She wants to make certain that a long term medical event doesn't become a financial burden to her family. She also has 5 grandchildren that she would like to ensure when she passes they will be guaranteed an inheritance they can use to pay for college, a down payment on a home, or just a start in life. In other words she wants a guarantee that a financial legacy is left to her family, specifically to her grandchildren.

After qualifying, she transfers $100,000 into her selected carrier's Life Legacy/LTC Combo plan and immediately creates a paid up $321,695 Tax-Free life insurance benefit. Should she pass away the day after the policy is placed in force her beneficiaries would receive a benefit that is greater than three times the transferred sum.

Should the LTC provision be triggered at any time, a monthly cash indemnity benefit based on the initial $321,695 face amount would be paid out to Rachel. Had she selected the 2% benefit her monthly LTC check would be $6,434 for 50 months, 100% income tax free. Should Rachel receive the monthly care benefit for 10 months, or $64,340 and pass away, her beneficiaries would receive the unused $257,355 ($321,695 – $64,340 = $257,355).

In 10 years, based on current assumptions, her Family Bank cash value account would have grown to $122,735 and in 20 years, $175,739. Should she need to access her cash at any time for an opportunity, education for a grandchild, or an emergency it would be available via policy loans or withdrawals. Any use of the cash however would decrease both the life insurance benefit and the LTC benefit.

If your desire is to create an instant guaranteed financial legacy for your family and you want to include a cash indemnity LTC benefit plus accumulate a robust Tax-Free Family Bank cash account, the Life Legacy/LTC Combo option should be your Leveraged Care Solution choice.

The Long- Term Care/Life Insurance Combo

The creativity genius inherit in the insurance industry is amazing, refreshing and extremely beneficial. Leveraged Care Solutions have been evolving since inception, giving Americans a total pallet of choices.

One such choice is what we refer to as the LTC/Life Insurance Combo, that has as its' main focus a robust monthly Cash Indemnity LTC benefit with a return of premium feature and a minor life insurance benefit.

With the LTC/Life Insurance Combo plan you reposition passive assets for the purpose of creating an LTC pool of Tax-Free cash that, depending on your age, and the inclusion of an inflation rider, can be valued as much as 10 times your deposit.

At the foundation of the LTC/Life Insurance Combo strategy is a life insurance policy that is immediately worth more than your initial deposit. Whenever you pass away, the Tax-Free life insurance benefit is paid out to your beneficiaries. Unlike the Legacy/LTC option, the life insurance benefit provided in the LTC/Life Combo is incidental to the plan in order to take full advantage of Section 844 of the Pension Protection Act.

The LTC/Life Combo wasn't designed to earn cash value through the years like the other Leveraged Care Solutions, but it does offer a full return of premium should you need to exit the plan after five years.

The primary focus of the LTC/Life Combo is to provide a strong LTC benefit and because you are transferring a passive asset it creates enormous leverage that the transferred asset doesn't have.

For example. Ron, a 65 year old male, has a $200,000 CD currently paying .005. This year he will earn in taxable interest of a mere $1,000.

For example. Ron, a 65 year old male, has a $200,000 CD currently paying .005. This year he will earn in taxable interest of a mere $1,000.

Should he experience an LTC event he would have $201,000 to help finance his care. Had he transferred the $200,000 into the LTC/Life Combo Leveraged Care Solution and selected the 6 year benefit period, his LTC benefit pool would have immediately increased to $838,224 resulting in a monthly benefit of $11,642 for 72 months.

Because this is a Cash Indemnity plan, when filing a claim, as long as you show you've incurred at least $1 of covered Long-Term Care expenses, you'll receive a monthly benefit payment that you can choose to spend however you wish. The monthly benefit cannot exceed the per diem amount allowed by HIPAA, (currently $10,800 per month). And if you choose to receive less than your maximum monthly benefit, the difference stays in your policy, extending the length of time your benefits may last.

Unique to certain LTC/Life Combo plans is an inflation protection provision that can help your policy benefits keep up with rising costs. One A+ carrier that we work with provides three inflation protection options: 3% simple interest, 5% simple interest and 5% compound interest.

For example had Ron deposited $200,000 into the LTC/Life Combo and selected the 5% compound Inflation Protection Option, he would immediately be insured for $292,900 and his first year monthly LTC benefit would be $7,868 for 72 months. In 15 years at age 80, his monthly LTC benefit would have increased to $15,578 for a total LTC pool of $1,271,497 – Six times his initial transfer of $200,000!

As you can see the main focus of the Leveraged LTC/Life Insurance Combo strategy is to provide for strong LTC benefits by repositioning a passive asset. To qualify for the LTC/Life Combo, eligible applicants pass a simple 30 minute phone interview with no exam or lab tests.

In Summary

The Leveraged Care Solutions path starts with your current age and health status. Most plans are available to age 80 and require moderate health. There are however, other variables that have an impact in determining which solution is best.

Cable TV, car payments, dinner for two, home owner's insurance and traditional Long-Term Care insurance are examples of an expense. Something we have to budget for. Leveraged Care Solutions are, simply put: a repositioned asset transferred – from your left pocket to your right pocket. When you list your assets on your balance sheet, your LCS Plan will be on the left side of the ledger. A positive entry.

More important, is the fact that your Leveraged Care Solution will provide the needed funds to take care of your long-term medical expenses should you ever be in a position where you cannot perform 2 of the 6 Activities of Daily or you become cognitively impaired. If you are fortunate to never trigger the LTC provision of your LCS Plan, an expanded benefit is passed to your beneficiaries.

Until next time,

David Phillips