Gift For Life

It is the most wonderful time of the year.

With our home office now in the upper suites at the Gilbert, Arizona San Tan Mall, the ornaments and lights are festively hanging on the trees, Santa’s workshop is in full operation, and the streets are bustling with shoppers trying to find that ONE special Christmas gift.

I have been planning estates for over 45 years. Through the years, I have reviewed thousands of estates from gigantic to tiny, from organized to a disaster, from the massive farms of Missouri to a Ma and Pa Pizzeria in Cleveland.

During my career I have been fortunate enough to help design and implement strategies that have literally created financial dynasties that will bless generations. Until the phone stops ringing, I believe I have an obligation to share my skills and knowledge with those who truly care about their family. Our goal is stated in our corporate mission: To help our clients create a Powerful, Productive Posterity.

Recently my oldest son and business partner, Todd, and his wife Camille, were looking at cashing in some of the equity they have in their home. They have six daughters ranging from 10 months to 13 years old. They are not only beautiful both inside and out, they, along with our other five grandchildren are the joys of our life and our most important asset.

Their realtor told them that if they were going to place the house on the market, it would have to be purged, especially the toy room. It was gut wrenching, but they had to perform the surgery. I saw many presents that had previously generated a quick smile of appreciation carted off to the Goodwill. It was the kind of event that gives Disney writers material for Toy Story 5, 6 and 7.

I know the girls appreciated the gifts and even played with them for a while, but the boxes of little used toys being sent to the thrift store reminded me of a program we instituted years ago that actually has true lasting power. A program that will allow you to give a gift that will bless your family in so many ways. A gift that they may not appreciate today, but one that they will bless you for later.

Because of your hard work and good fortune, you are now in a position to financially assist your children and grandchildren by giving them a Christmas gift that will last a lifetime. We call it:

A Gift For Life.

What is this forever Gift For Life? Simply stated, it is a Maximum Funded Family Bank permanent life insurance policy on their life.

For certain, you won’t find a Max Funded Family Bank life insurance policy at the top of any grandchild’s wish list. However, unlike another toy or electronic device, the Gift For Life won’t be something they will ever outgrow. In fact, there are a myriad of reasons why giving a Gift For Life insurance to a child or grandchild makes economic and rational sense.

- It can lock in their insurability, hedging against unforeseen health issues that might prevent them from getting life insurance later in life. Some plans even guarantee their future insurability should they want more coverage later.

- It starts building Tax-Free cash value early on. Starting The Family Bank at a younger age gives the money more time to compound. This increase in cash value will come in handy when it comes time for them to:

- • Pay college tuition

- • Pay for a wedding

- • Pay for a honeymoon or other vacations

- • Purchase their first home

- • Help with the expenses of child birth

- • Create an emergency fund

- • Pay for unforeseen medical expenses

- • Or even build a Tax-Free retirement income.

- It is a unique cash asset class. As such, the cash value in the Gift For Life Family Bank policy is not counted with other assets when seeking financial aid.

- It locks in lower premiums. It costs much less to buy life insurance when you are young and healthy. By establishing a policy for them when they are in their youth, you will be locking in that lower premium.

- It instills a sense of responsibility. This is why a Family Bank life policy makes a tremendous wedding gift, as getting married is the gateway to a world of larger responsibilities, such as a mortgage, spouse, and children.

- It provides a life insurance benefit. Because of the many living benefits a Max Funded Family Bank Gift For Life provides, it is clear the life insurance benefit is the secondary purpose, but it is an important benefit none the less. In an era when students are graduating with enormous student debt, to say nothing of car loans and huge credit card balances, the Tax-Free life insurance pay out is extremely valuable.

- It is creditor proof in most states. Because of Section 101 of the IRC, all life insurance is protected from creditors and predators, making it an extremely valuable asset in your overall portfolio.

- It compounds interest Tax-Free. Tax-Free is always better than taxable. Cash can be accessed free from income tax via the Variable (Participating) Loans or the Wash Loans.

- In most cases for those under 16, no qualifying medical exam is required.

Who should own each Gift For Life Family Bank Strategy? The answer depends on the circumstances.

As the donor you decide up front. Before I explain the options, let’s first review the current federal gift tax rules:

- The annual federal gift tax allowance is $15,000 per spouse, per recipient, per year, or $30,000 per couple. What this means, as a married couple, you can transfer from your estate to each child or grandchild up to $30k each, gift tax free each year.

- Currently, each of us can gift, while we are alive or at death, our lifetime exclusion of $11,400,000 gift tax and estate tax free. This allowance (or a portion) can be gifted in pieces throughout our lives along with the annual gift.

Gift For Life Ownership Options:

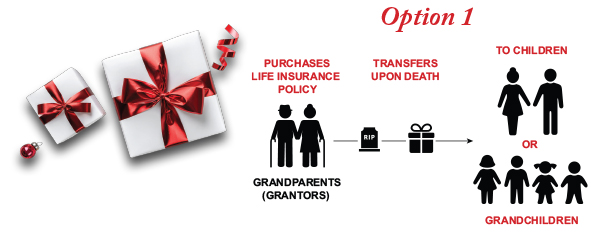

Option 1:

If you want to control the cash value with the right to withdraw it as needed, you should be the owner and beneficiary of each Gift For Life policy. When you and your spouse pass away you could transfer the policies to your children or grandchildren. The transfer would be considered a gift, but you and your spouse could use both your annual gift allowance of $15,000 and a portion of your $11,400,000 federal estate tax exclusion.

Throughout your lifetime you would call all the shots and decide when the funds are to be distributed to the recipient for this or that. For tuition, a car, equipment for the new dental office, real estate. The uses are endless and the distributions are Tax-Free.

We often we use this approach when a client wants to establish the Family Bank Strategy for himself/herself but for some reason can’t qualify medically.

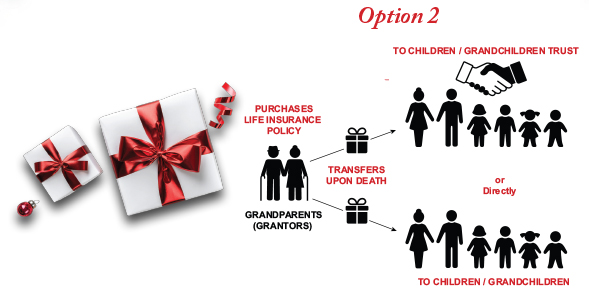

Option 2:

You make an actual gift of the premium deposit each year, for the specified number of years that you decide, directly to the insurance company for their benefit. Because it is a transferred gift you would lose control over the cash value. Many opt to make this kind of an irrevocable gift; however, they place the funds inside a trust that controls the distributions of both the cash value and the life insurance benefit.

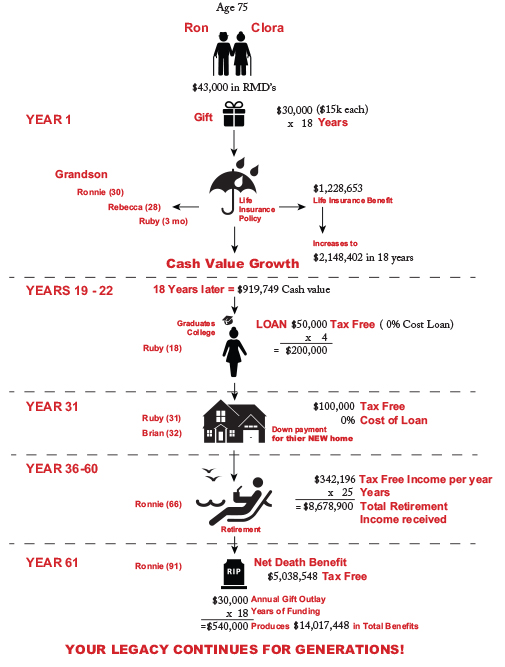

Example 1: The Multi-Generation Strategy

Ron and Clora, are both 75 and retired. Ron was an MD for 40 years and together they have an estate of almost $4 million, of which $1 million is in Ron’s IRA. His IRA Required Minimum Distribution (RMD) will be $43k this year. Stephen, their 55 year old son is married to Janice and they have a son, Ronnie, (30) that married Rebecca two years ago. Ronnie and Rebecca are proud parents of a 3 month old girl, Ruby.

Ron and Clora would like to give their grandson Ronnie (Ron’s namesake) a Gift For Life. They decide to outright gift the $30k annually to Ronnie for 18 years and select a top Max Funded (Stuffed) Indexed Universal Life insurance policy from one of our top A+ carriers.

Let’s look at the amazing results their generosity will create:

- Ronnie is immediately insured for $1,228,653. While the life insurance benefit is secondary to the equation, it is still there and will actually increase through the years so that in 10 years it will have grown to $1,567,388.

- In 18 years, when Ruby is entering college , Ronnie wants to help with her tuition and other expenses so he borrows $50,000 a year for four years from the insurance company, using the cash value as collateral. Because the loan is taken after the policy has been in force for 10 years the cost to borrow is zero, resulting in tax free means to pay her tuition.

- When Ruby is 31 , Ronnie borrows another $100,000 to help Ruby and her husband Brian with their down payment on their first home. Again there is zero cost to borrow from his Gift For Life and because the loan will eventually be subtracted from the life insurance payout, there is no pressure to pay back any of the loans.

- When Ronnie turns 66, 35 years from now , because there is so much accumulated cash value, he begins to receive TAX-FREE income for the next 25 years of $347,156 a year, for a total income payout through the years of $8,678,900.

- At age 91 Ronnie passes away. All of the loans that he has either received or given to Ruby are paid back and his family receives a NET life insurance payout of $5,038,548!

I know this all sounds too good to be true, but the truth is factual. This kind of multi-generational planning goes on all day, every day and it is real. Company selection is critical and we have done extensive research to find the right carrier and plans for this kind of wealth transfer and wealth creation.

What if Ron and Clora pass away before the 18 years of funding is complete? No problem. Ron and Clora have designated that a small portion of their estate will flow into a trust in the name of Ronnie to make certain that the policy is paid up as planned. An inheritance that he would have received anyway, but this way it will be leveraged into creating millions of dollars for Ronnie and his posterity, who just happens to also be Ron and Clora’s posterity.

Example #1

Example #2: The Gift to a Grandchild Strategy

Troy, 68 and Vicki, 67 are proud grandparents of Wyatt who just had his 10th birthday. They would like to establish a Gift For Life for Wyatt that will bless him throughout his life. Among other assets Troy has an IRA valued in excess of $800,000. If it continues to grow at 5%, it will be worth $926,000 in three years. His RMD will be $33,795 at that time.

They would like to take advantage of the current favorable tax brackets and get a head start on their IRA distribution now by depositing $10k per year for 10 years into a Max Funded Family Bank for Wyatt. Eventhough the premium deposits would cease after 10 years, the Gift For Life would continue to give throughout his life.

They are deciding between a Whole Life plan and an Indexed Universal Life plan, both being offered by top rated, 100+ year old companies.

Let’s take a look at the results of our study:

Participating Whole Life – Assuming current dividend scale

Immediate Life Insurance Benefit = $787,751

Life insurance Benefit in 10 years = $1,591,282

Cash and Dividend Value in 10 years = $113,987

Cash and Dividend Value in 20 years = $200,030

Cash and Dividend Value in 30 years = $336,964

Index Universal Life Insurance – Assuming 6% average return

Immediate Life Insurance Benefit = $987,119

Life insurance Benefit in 10 years = $1,083,512

Cash Value in 10 years = $113,726

Cash Value in 20 years = $200,986

Cash Value in 30 years = $374,322

Think of the amazing life-long benefits Wyatt’s grandparents are providing him by depositing $100k over 10 years!

- Over $1,000,000 of life insurance that he will be able to use as the foundation of his own personal financial plan.

- A rich Tax-Free source of cash Wyatt can use (at the permission of his grandparents as long as they are alive) throughout his lifetime for any number of financial events:

- • College expenses

- • A down payment on his first home

- • Wedding/Honeymoon

- • A car

- • Business opportunities, etc.

With either the Whole Life or IUL policy Wyatt’s accumulation value is scheduled to surpass $200,000 by the time he is 30 and $350,000 by age 40. This is the kind of financial legacy that can only be achieved through permanent life insurance.

Furthermore, with the benefit of time, starting the Gift For Life program early for your children and grandchildren enables the cash in the policies to compound exponentially, all under a Tax-Free umbrella. Your posterity will be able to reap untold benefits throughout their lives from your gift.

When designed correctly with proper planning foresight, and commitment permanent life insurance is a true financial miracle.

As I plan the estates of today’s intelligent affluent, there is one common denominator pattern that I have observed: They don’t just plan for today or tomorrow, they plan for generations – multi-generations!

To see how the Gift For Life would positively impact you and your children and/or grandchildren call for Sara at 1-888-892-1102 and she will schedule an appointment with either me or Todd to discuss your specific family dynamics and how the Gift For Life will create a true financial dynasty for generations.