Bob Carlson's - Multiplying the Money Available for Long-Term Care

Multiplying the Money Available for Long-Term Care

Traditional long-term care insurance might be dying, but there are other, and probably better, ways to protect your family and assets from the potentially onerous costs of long-term care.

In 2017, only 66,000 traditional longterm care (LTC policies) were sold. That’s 10% of the number sold 20 years earlier. Steep premium increases on existing policies are the main reason traditional LTC insurance is in decline. In August, regulators in 22 states approved another 58% increase in premiums on some existing Genworth policies. That follows 28% increases in each of the last two years. Other insurers have had significant increases approved in recent years.

Insurers say buyers of new policies aren’t likely to face such premium increases in the future, but there’s no assurance. Potential buyers are understandably skeptical. Also, traditional LTC policies still have the longstanding use-it-or-lose-it feature. If you don’t need much long-term care during your life, all you receive for paying premiums through the years is peace of mind.

Yet, you still need to prepare for long-term care. About 25% of Americans who turn age 65 between 2015 and 2019 will need up to two years of LTC during their lifetimes, according to a federal government report. Two to five years of care will be needed by 12%, and 14% will need more than five years of care.

The cost varies by location and the level of care needed. Home care provided by aides generally costs $15 to $20 per hour. Assisted living is more expensive (often $4,000 or more per month), and nursing home care is the most expensive, costing more than $100,000 per year in most places. You can find data on the cost of different kinds of care around the country on the Genworth website.

Unless you’re able and willing to pay such costs yourself, you need a plan to protect your wealth and estate. The best option often is a Hybrid LTC policy, also known as an Asset Based Care Plan, or The Leveraged Care Solution. These are life insurance policies or annuities with LTC benefits.

The policies give you the certainty of receiving a particular benefit payment for a fixed period if you need LTC. They also multiply your savings. The amount you deposit in a policy automatically becomes two times, three times or more in LTC benefits. In addition, if you don’t need LTC or need only a small amount, there are life insurance benefits or an annuity balance payable to your beneficiaries. You aren’t subject to the use-it-or-lose-it rule.

That’s why the hybrid policies gradually have been replacing traditional LTC policies, with almost 500,000 hybrid policies acquired last year. I’m pleased to report that one of the best hybrid policies recently became even better.

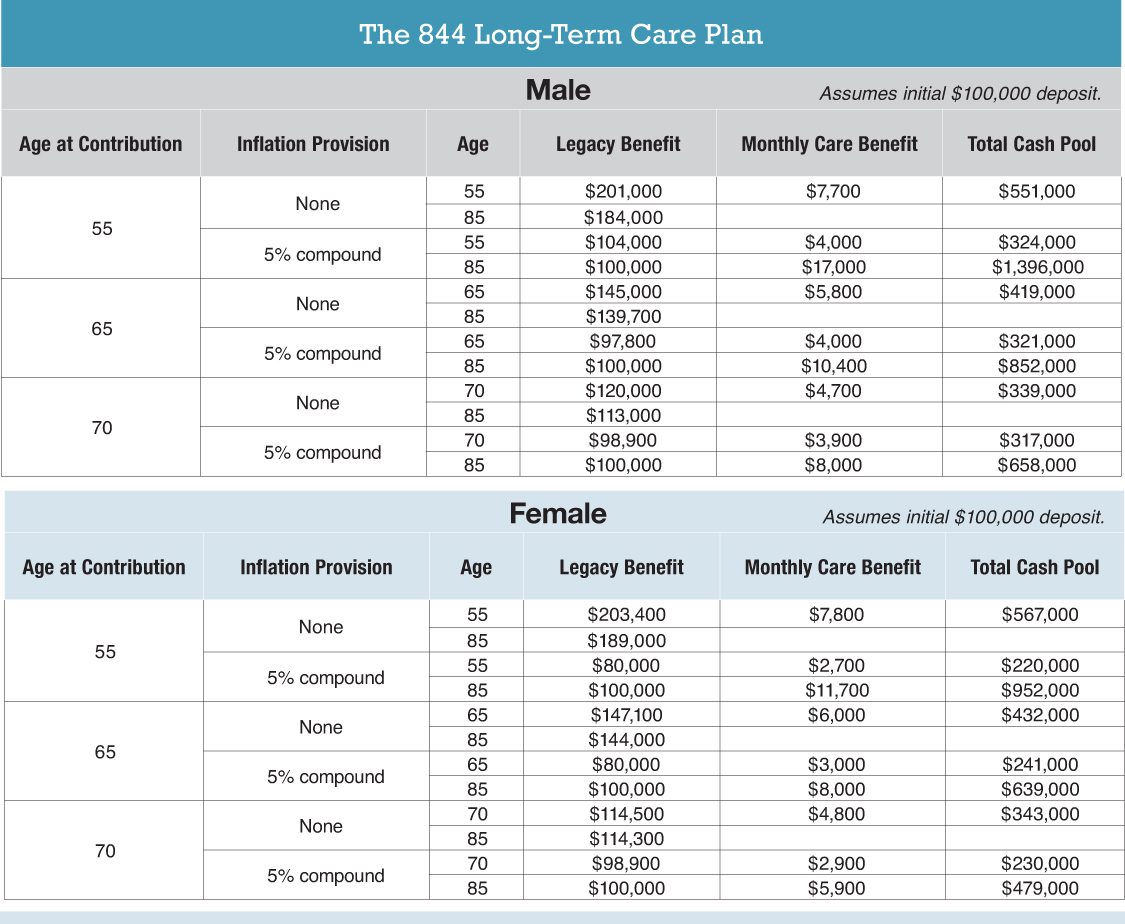

This LTC/Life hybrid from an A+ rated carrier is referred to as the 844 Plan. You buy a universal life policy and an LTC rider. Immediately, you have the life insurance benefit and a cash value account plus the LTC benefits. The LTC benefits will always be significantly more than your deposit. Exactly how much more depends on your age, sex, the deposit schedule you choose and some other factors. You also can select inflation protection for your LTC benefit.

You can see from the accompanying table examples of coverage at different ages with and without inflation protection, assuming a deposit of $100,000. Benefits begin 90 days after a certified caregiver verifies that you need help with at least two of the six activities of daily living or you have cognitive impairment. You choose in advance to have benefits paid over a period from 48 to 84 months.

LTC benefits received under the policy are tax free. Another important feature of the 844 LTC Plan is that it provides indemnity benefits instead of reimbursement benefits. Traditional LTC policies and many hybrid policies provide reimbursement benefits. You first incur the LTC expenses. Then, you submit receipts and other documentation to the insurer and wait for reimbursement. Also, the policy will reimburse only covered expenses. Not all the LTC expenses incurred will be reimbursed. Try doing all that paperwork when you need LTC.

An indemnity policy, on the other hand, begins monthly payments after the 90-day waiting period. No receipts are required, and you don’t have to wait for reimbursement. Also, you can spend the money on anything. You don’t even have to be in a facility or use licensed care providers. You can be receiving care at home informally from a family member. In other words, this isn’t “nursing home insurance.” You decide how to receive the LTC you need. Unlike traditional LTC policies, with the 844 LTC plan you can choose after five years to cancel the policy and have your full deposit returned. Here’s how the policy recently was enhanced.

Hybrid policies require a lump sum premium, and the minimum usually is $50,000 to $100,000. To receive higher LTC benefits, you deposit a larger amount. Many people are hesitant to take out the coverage, because they aren’t comfortable transferring so much of their liquid assets at one time. Others don’t want to sell investments or draw down IRAs because of the taxes that would trigger in one year.

Now, you don’t have to worry about that. The 844 LTC Plan can now be paid with multiple deposits over several years. You can choose a lump sum or payments over one, five, seven, ten, or 15 years. If you are under age 71 you can obtain coverage without having to

deposit a significant sum at one time. The minimum deposit is one that will produce at least a $50,000 life insurance benefit. Depending on your age and other factors,it could be as low as $5,000. The maximum deposit is $500,000. You obtain more coverage and life insurance by using the single-premium option. You need to examine the effects of the different payment options and determine which trade-offs you prefer.

The 844 LTC Plan is available to people between ages 40 and 75. There’s no medical exam. You answer some questions about your medical history and take a cognitive impairment test, which can be taken over the telephone. The insurer is a solid A+ rated carrier that has been in business for about 130 years.

I was alerted to the 844 LTC Plan by David and Todd Phillips of Estate Planning Specialists, my go-to source for the best in life insurance, LTC and annuities. For more information about this and other hybrid LTC policies or to receive a personal example, contact David and Todd at 888-892-1102.