Bob Carlson's - July 2017

Solving the Long-Term Care Conundrum

Long-term care expenses are one of the great retirement fears. For many people, the cost and uncertainty of long-term care are only one reason for the anxiety. Even more anxiety is triggered by trying to sort through the options to fund potential long-term care expenses. Comparing the choices baffles even many financially savvy people and advisers.

In the past, I've presented different strategies and tools to finance longterm care (LTC). This month, I show you how to analyze several choices and pick the one, or the combination, that is best for you.

In addition to personal and family assets, you want to consider traditional stand-alone long-term care insurance (LTCI) policies, LTC annuities, and life insurance/LTC combo strategies (referred to as Legacy Life/LTC), and LTC/Life Combo policies. Be sure to review more than one offering from each category. The offerings from different insurers vary greatly. You should work with either several brokers and agents or one who can offer products from all or most of the insurers. Most agents and brokers offer products from only a few insurers.

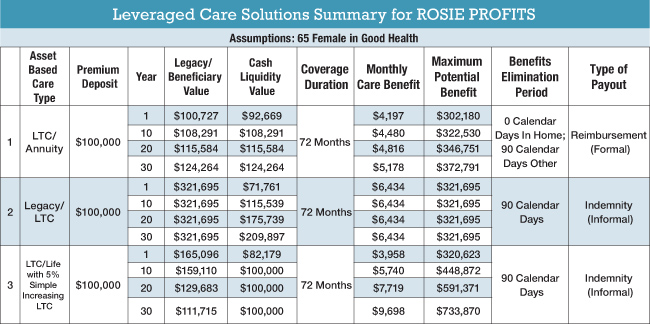

Drill down to compare the key factors of the coverage. Either prepare a spreadsheet similar to the one with this article or have the financial professional you're working with prepare it.

This update was prepared by Todd Phillips of Phillips Financial Services, and shortly we'll discuss the case it represents. The spreadsheet allows you to make an apples-to-apples comparison instead of focusing on only a few factors emphasized in company sales materials.

These are the factors you want to pay attention to.

Coverage triggers: In the early days of LTCI, policy coverage was triggered only in limited circumstances. If you buy any type of LTC coverage, you want coverage to kick in after a medical professional determines that the insured is unable to perform two or more of the six activities of daily living or has cognitive issues. A hospital stay shouldn’t be required before coverage kicks in.

Covered care: The whole range of long-term care services should be covered, including adult day care, home care, assisted living and nursing home care. Many policies now will cover care provided informally, such as by a relative or close friend. Avoid policies that limit the types of covered care or who can provide that care. Some, for example, will pay only for care provided by people with certain certifications.

Elimination period: This also is known as the deductible. It is the period of time you must pay for LTC before the insurance coverage kicks in. The standard elimination period for LTCI is 90 days, but you often can increase or decrease it within limits. A longer elimination period is attractive to many people, because it reduces the premium or increases LTC benefits. But make sure you have other income or assets to fund the care during the elimination period. Be aware that Medicare might cover most long-term medical expenses for the first 90 days.

Cost: With the LTCI policies, you'll pay annual premiums. These can be hard to determine over the long-term, because insurers can raise the premiums after receiving the approval of the state insurance commissioner. As you're probably aware, premium increases in recent years have been substantial in many cases. Many insurers and LTCI experts believe the insurers corrected the errors that led to these huge increases and future increases are less likely.

With the LTC combo annuities and life insurance policies, you usually make a lump sum deposit to acquire a policy. However, some plans allow for LTC coverage to be acquired with smaller annual deposits.

Type of payout: There are two main ways LTC products pay benefits.

Under the reimbursement method, you first pay the long-term care provider. Then, you present the proof of payment to the insurer and receive a reimbursement check for the covered amount.

The cash indemnity method is simpler. After the insurer agrees that the coverage has been triggered and you quality for LTC benefits, you receive a check each month for the amount stated in the contract. Under the indemnity method, the amount received from the insurer isn't related to your LTC costs, and you are free to spend the money however you wish.

Future benefit: You want to know the benefits the policy will pay in the future when you're likely to need care, especially since the cost of LTC increases faster than general consumer inflation.

With traditional LTCI, the daily benefit can be indexed for inflation. With most of the LTC annuities and Life/ LTC Combo options, the future benefit usually is based on a combination of your initial deposit and the compounded earnings of the account. Insurers have different formulas for turning your cash value into LTC benefits. That's why the best way to compare policies is to estimate the monthly benefit at different points in the future using the same investment and economic assumptions. Some of the newer Life/Combo plans have a true inflation provision.

Coverage duration: Unlimited lifetime LTC coverage rarely is available now. Today's choices usually cover six or fewer years of care, and you often can select the coverage period. The longer the coverage period, of course, the more expensive the policy's cost or the lower the monthly benefit.

Maximum potential benefit: This is another way of looking at the future monthly benefit and the coverage duration. Multiplying the two gives you the maximum lifetime benefit payout. It's a good apples-to-apples comparison.

No-LTC values. Traditional LTCI is a use-it-or-lose-it product. If you never need LTC or need only a small amount, you receive no financial benefit from all the premiums you paid. You'll have some peace of mind from knowing the coverage is there if you need it, but you won't receive a financial benefit.

A selling point of the Combo plans is there's still a benefit for your heirs if you don't need a lot of LTC. The beneficiaries could receive the life insurance benefit or the value of the annuity contract. Also, if you decide you need some cash even when you don't need LTC, you will be able to tap an annuity or the cash value of life insurance.

For those reasons, your analysis should include the cash value of the policy for you at different time intervals, as well as the benefit to your beneficiaries. Again, this is an easy way to cut through the sales talk and compare the real benefits of different products.

Reduction in beneficiary values. You might need some LTC but not enough to exhaust the policy benefits. In that case, there still might be a benefit for your beneficiaries.

In most of the annuities and life insurance, if you draw LTC benefits, the amount available to beneficiaries is reduced or discounted, though there are a few exceptions. The insurers have different formulas for reducing what a beneficiary will receive. You need to understand the amount that will be available to beneficiaries under different scenarios.

LTC benefits vs. growth: Some of the Combo annuity and life insurance products emphasize the growth potential of the cash value. In those cases, the amount of LTC benefits is secondary. Other plans try to maximize the LTC benefits at the point when you're likely to need them, and this causes cash value and death benefits to be lower.

You need to determine the primary purpose for the product. Do you want to maximize potential LTC benefits, or is the growth of your cash value more important?

I can't stress enough that you need to shop around and consider all your options. The cost of very similar options can vary by as much as 100%, and alternatives that seem similar on the surface can provide very different benefits once the details are clear.

Tax treatment: With most products any LTC benefits will be free of federal income taxes. But verify that with the insurance representative before choosing.

Now, let's take a look at a case study. Rosie Profits is a 65-year-old woman in good health. She wants some kind of insurance coverage for the bulk of any LTC needs she might have in the future. She has other assets and sources of income she wants to protect, so her focus is on maximizing LTC benefits for her dollar.

The table compares the key elements of several different annuities and life insurance policies with LTC benefits, including several I've discussed in the past. These were the final candidates from a longer list of policies that was considered. Most of the choices considered were permanent life insurance policies because they pay their claims using the indemnity method. Our research didn't find any LTC/Annuities that used the indemnity method. They all used the reimbursement method.

Rosie chose the last option, Long-Term Care/Life with the 5% simple increasing LTC, which was Minnesota Life's SecureCare, the plan I presented as SecureCare in the April 2017 issue.

Rosie had several reasons for this choice. The policy offers greater maximum monthly care benefits and total potential benefits in her later years, when Rosie believes she is most likely to need care. Also, the coverage lasts for 72 months, which is among the longest benefit periods available.

In addition, this is an indemnity policy, which means Rosie receives the maximum monthly benefit regardless of how much her LTC costs. She can save any amount that exceeds the cost of her care so that it's available if she needs care after 72 months. Or she can spend the excess to support someone else or for other expenses.

Though Rosie's goal is to maximize her LTC benefits, the cash value if she doesn't need care and the benefits available to her heirs are sizable and competitive with other policies. Someone who wants both a high death benefit and LTC benefit would strongly consider the Legacy/LTC policy instead.

To receive your personalized LTC Combo comparison chart, call Phillips Financial Services at 1-888-892-1102. You also can order a new 40-page Special Report on the subject by David Phillips and Todd Phillips, Leveraged Care Solutions: Answers to Today's Long Term Care Crisis. It's free online, or a printed color copy is available for $5.95 (the cost of shipping). Call the number above to order.